May 2023: The Business Inflation Expectations Survey (BIES) provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit, sales levels, etc. The survey is unique in that it goes straight to businesses - the price setters - rather than to consumers or households, to understand their expectations of the price level changes. One major advantage of BIES is that one can get a probabilistic assessment of inflation expectations and thus get a measure of uncertainty. It also provides an indirect assessment of overall demand condition of the economy. Results of this Survey are, therefore, useful in understanding the inflation expectations of businesses and complement other macro data required for policy making. With this objective, the BIES is conducted monthly at the Misra Centre for Financial Markets and Economy, IIMA. A copy of the questionnaire is annexed.

Companies are selected primarily from the manufacturing sector. Starting in May 2017, the “BIES - March 2023” is the 71st round of the Survey. These results are based on the responses of around 1000 companies.

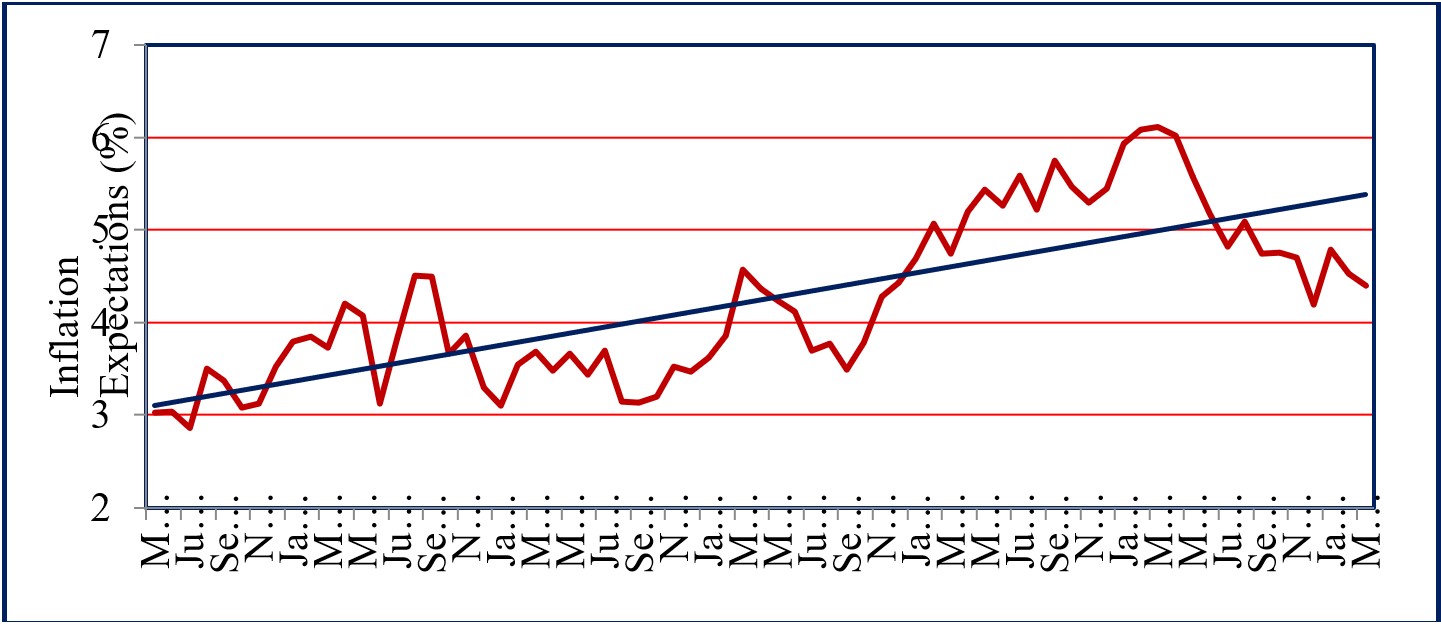

A. Inflation expectations

Chart 1: One year ahead business inflation expectations (%)

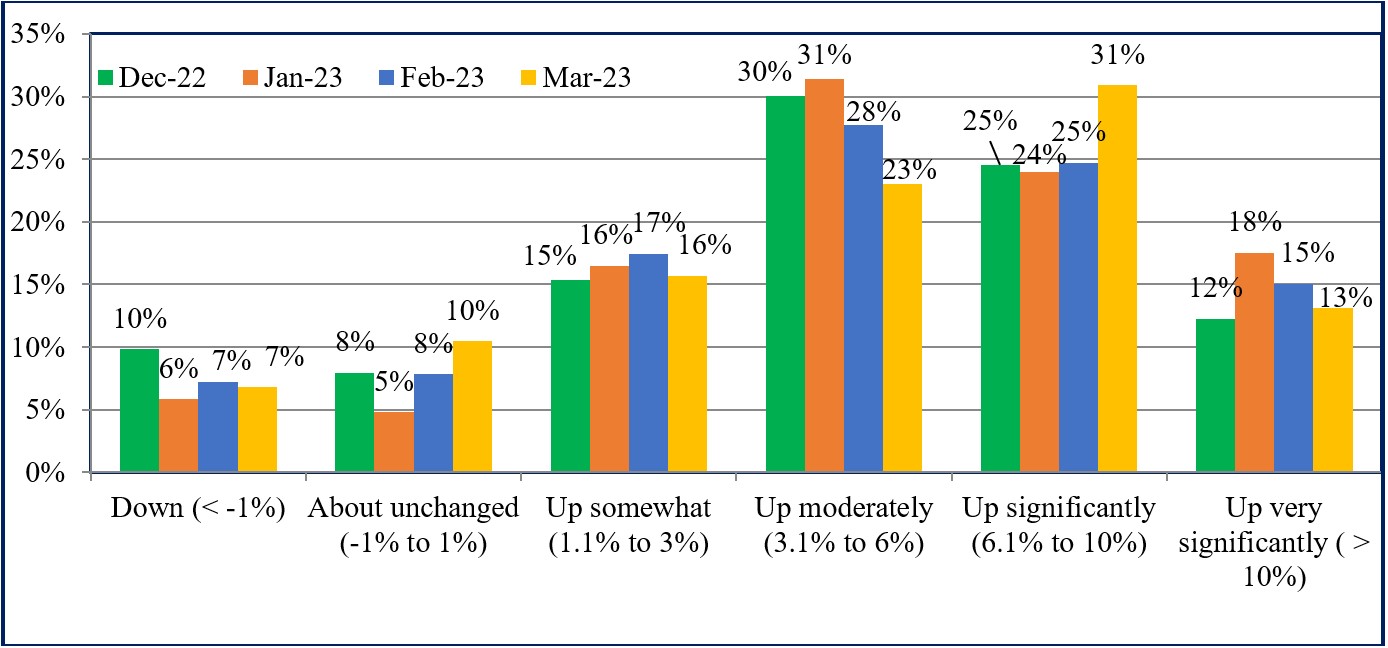

B. Costs

Chart 2: How do current costs per unit compare with this time last year? – % responses

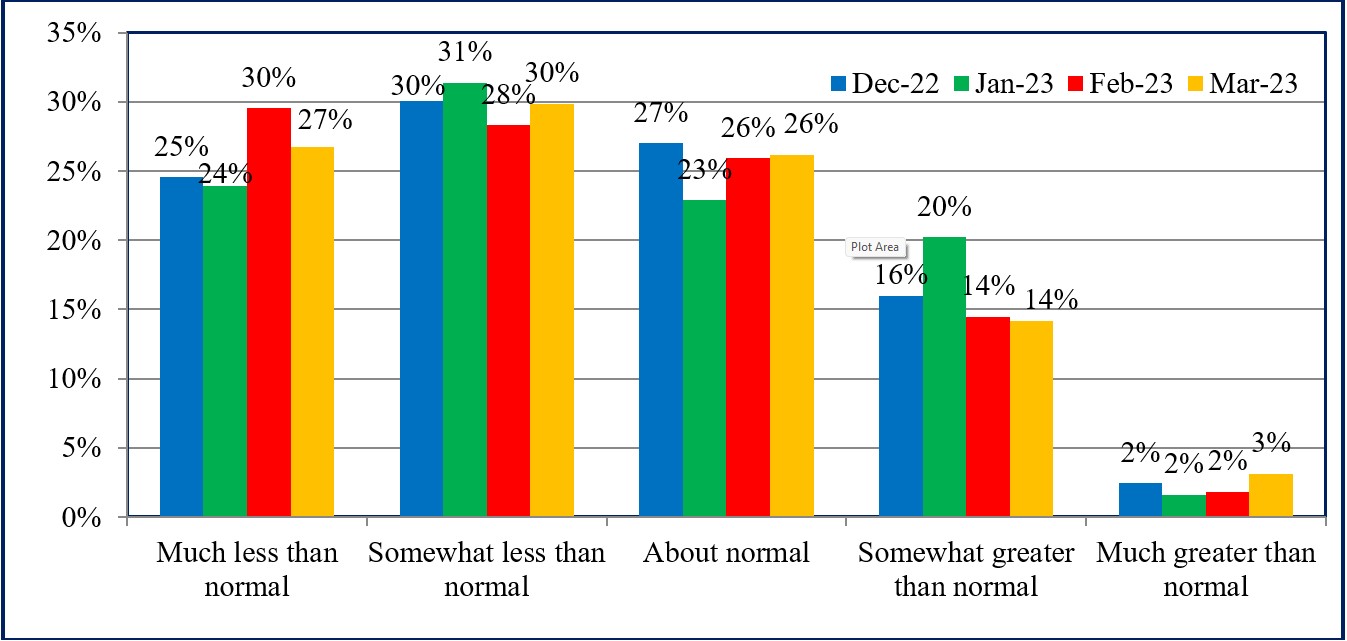

C. Sales Levels

Chart 3: Sales Levels - % response

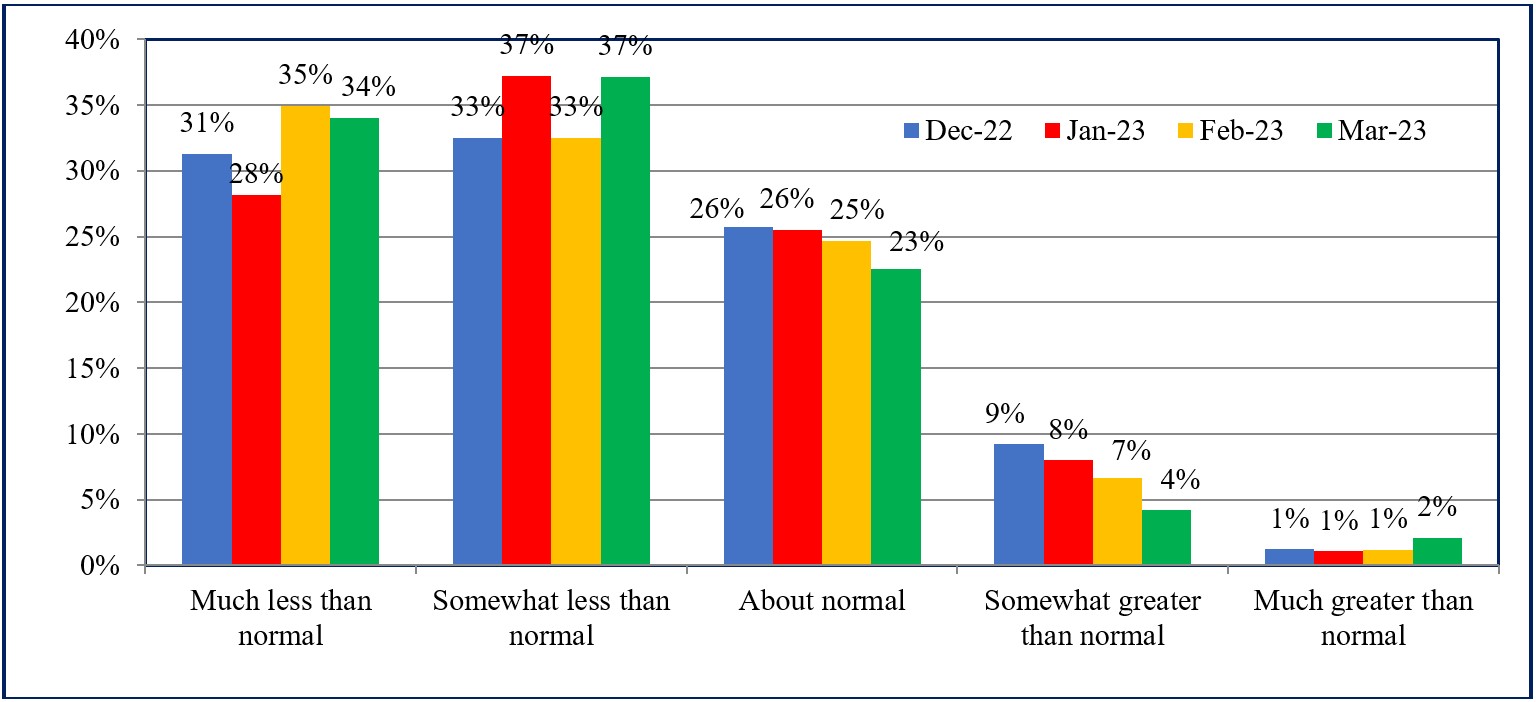

D. Profit Margins

Chart 4: Profit Margins - % response

Business Inflation Expectation Survey (BIES) – Questionnaire

|

A. Current Business Conditions Q1. How do your current PROFIT MARGINS@ compare with "normal"* times? o Much less than normal o Somewhat less than normal o About normal o Somewhat greater than normal o Much greater than normal Q2. How do your current sales levels compare with SALES LEVELS@ during what you consider to be "normal"* times? o Much less than normal o Somewhat less than normal o About normal o somewhat greater than normal o Much greater than normal @ of the main or most important product in terms of sales. *"normal" means the average level obtained during the corresponding time point of preceding 3 years, excluding the Covid-19 period. |

||||||

|

B. Current Costs Per Unit^ Q3. Looking back, how do your current COSTS PER UNIT^ compare with this time last year? o Down (< -1%) o About unchanged (-1% to 1%) o Up somewhat (1.1% to 3%) o Up moderately (3.1% to 6%) o Up significantly (6.1% to 10%) o Up very significantly (> 10%) o ^ of the main or most important product in terms of sales. |

||||||

|

C. Forward Looking Costs Per Unit$ Q4. Projecting ahead, to the best of your ability, please assign a percent likelihood (probability) to the following changes to costs per unit$ over the next 12 months.

o Unit costs down (less than -1%) o Unit costs about unchanged (-1% to 1%) o Unit costs up somewhat (1.1% to 3%) o Unit costs up moderately (3.1% to 6%) o Unit costs up significantly (6.1% to 10%) o Unit costs up very significantly (>10%) $ of the main or most important product in terms of sales. Values should add up to 100%. |

The Indian Institute of Management Ahmedabad (IIMA) is a premier, global management Institute that is at the forefront of promoting excellence in the field of management education. Over the 60 years of its existence, it has been acknowledged for its exemplary contributions to scholarship, practice and policy through its distinctive teaching, high-quality research, nurturing future leaders, supporting industry, government, social enterprise and creating a progressive impact on society. IIMA was founded as an innovative initiative by the Government, industry, and international academia in 1961. Since then, it has been consolidating its global footprint and today it has a network with over 80 top international institutions and a presence in Dubai. Its eminent faculty members and more than 40,000 alumni, who are at the helm of influential positions in all walks of life also contribute to its global recognition. Over the years, IIMA’s academically superior, market-driven, and socially impactful programmes, have earned high reputation and acclaim globally. It became the first Indian institution to receive international accreditation from EQUIS. The institute also is placed first in the Government of India’s National Institutional Ranking Framework (NIRF), India Rankings 2023. The Institute has been ranked number 1 in India, number 2 in Asia and the 35th, globally, in the Financial Times (FT) Executive Education Rankings 2023. The renowned flagship two-year Post Graduate Programme in Management (PGP) is ranked 26th in the FT Masters in Management Ranking 2021 and the one-year Post Graduate Programme in Management for Executives (PGPX) has been ranked 62nd in the FT Global MBA rankings 2022.

IIMA offers consultancy services and more than 200 curated executive education programmes in customized, blended, and open enrolment formats for a diverse audience comprising business leaders, policymakers, industry professionals, academicians, government officials, armed forces personnel, agri-business and other niche sector specialists and entrepreneurs.

To know more about IIMA, please visit: https://www.iima.ac.in/

For media queries, please contact:

Kamla Chowdhry Communication Hub

Varshaa Ratnaparke | vp-communications@iima.ac.in

Sunitha Aravind | pr@iima.ac.in | +91-8450 900 643