A. Inflation expectations

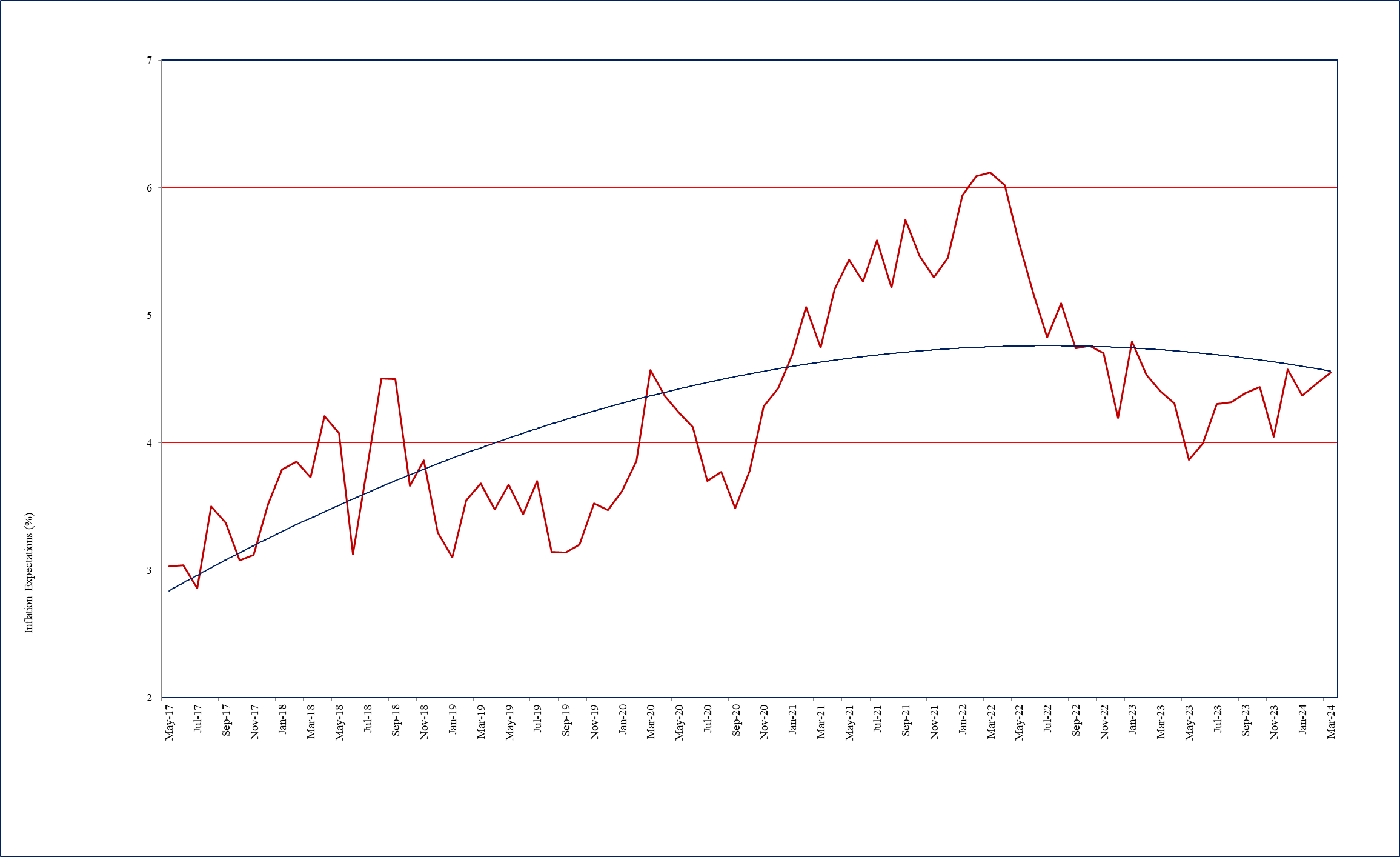

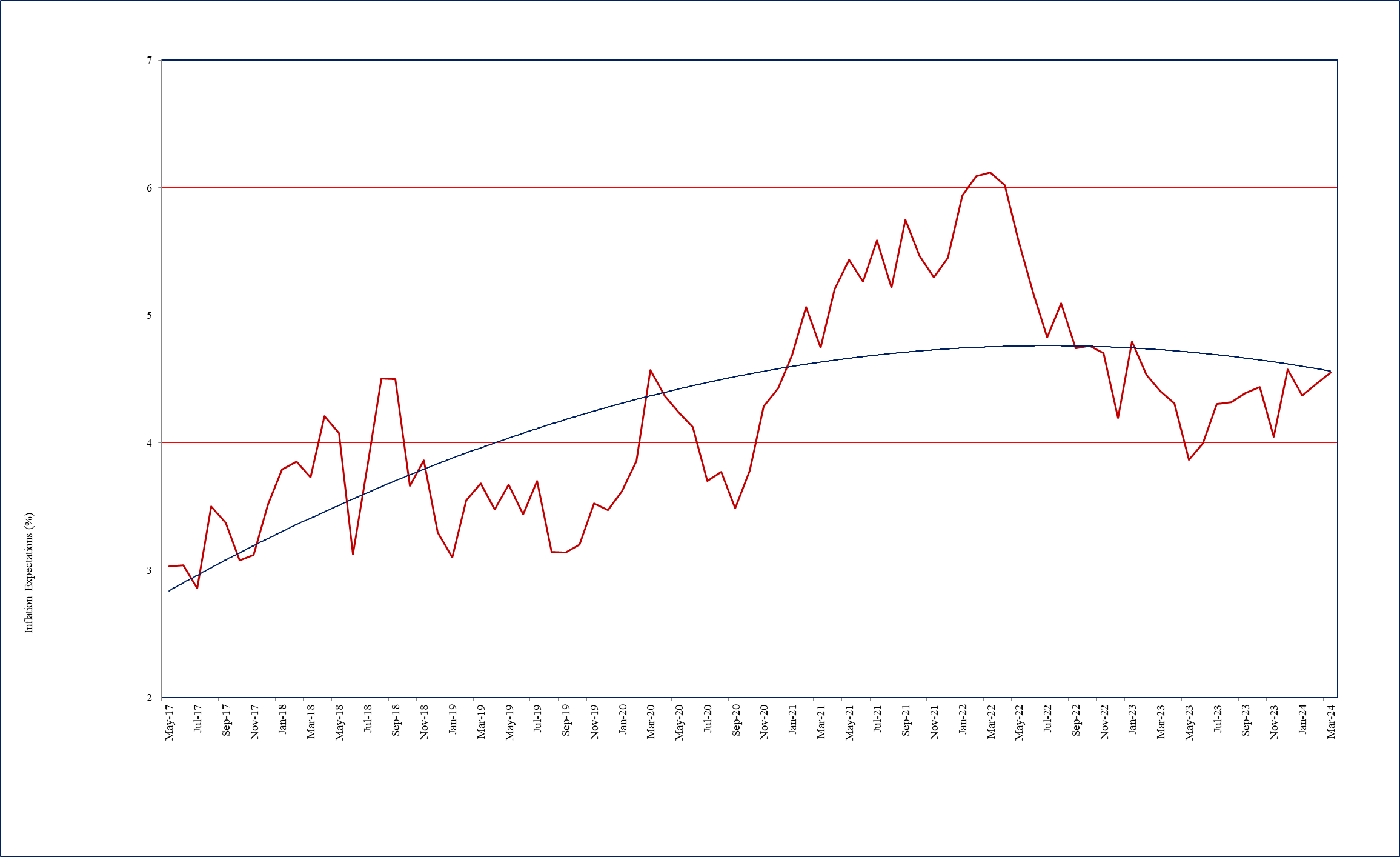

- One year ahead business inflation expectation, as estimated from the mean of individual probability distribution of unit cost increase, has increased further by 9 basis points to 4.55% in March 2024 from 4.46% reported in February 2024. Average inflation expectation of the firms for the past twelve months works out to be around 4.40%. The trajectory of one year ahead business inflation expectations is presented in Chart 1.

- The uncertainty of business inflation expectations in March 2024 as captured by the square root of the average variance of the individual probability distribution of unit cost increase, remained high around 2.1% during January-March 2024.

Chart 1: One year ahead business inflation expectations (%)

B. Costs

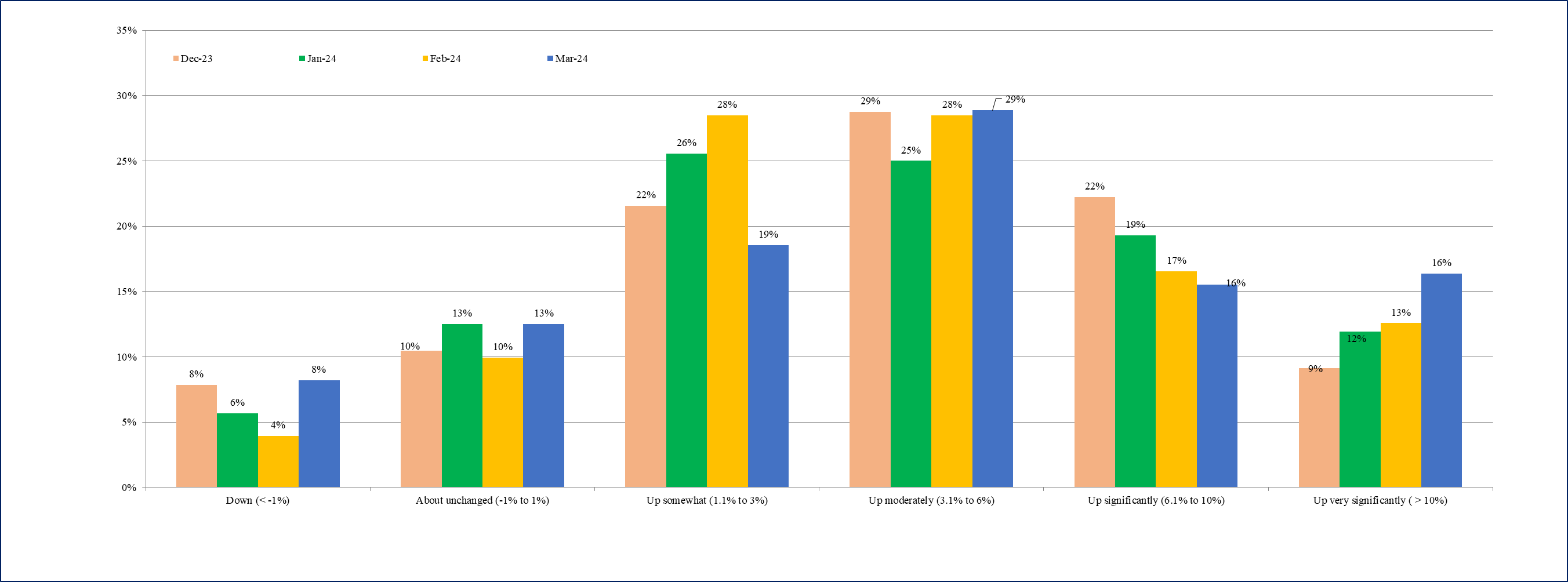

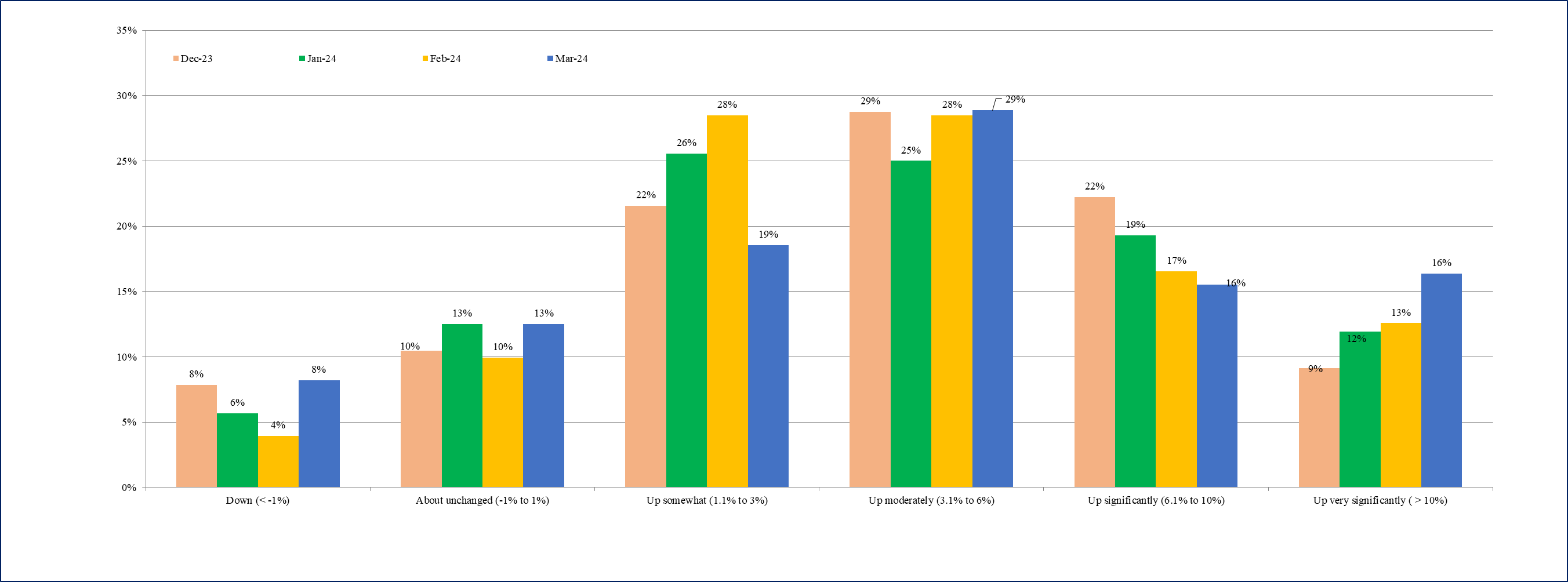

- The cost perceptions data in March 2024 indicate mild increase in cost pressures. However, the percentage of firms perceiving very significant cost increase (over 10%) in March 2024 has increased to 16%, from around 13% reported in February 2024 (Chart 2).

1 The Business Inflation Expectations Survey (BIES) provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit, sales levels, etc. The survey is unique in that it goes straight to businesses - the price setters - rather than to consumers or households, to understand their expectations of the price level changes. One major advantage of BIES is that one can get a probabilistic assessment of inflation expectations and thus get a measure of uncertainty. It also provides an indirect assessment of overall demand condition of the economy. Results of this Survey are, therefore, useful in understanding the inflation expectations of businesses and complement other macro data required for policy making. With this objective, the BIES is conducted monthly at the Misra Centre for Financial Markets and Economy, IIMA. A copy of the questionnaire is annexed.

Companies are selected primarily from the manufacturing sector. Starting in May 2017, the “BIES – March 2024” is the 83 rd round of the Survey. These results are based on the responses of around 1100 companies.

- The percentage of firms reporting moderate cost increase (3.1% to 6.0%), on the other hand, has remained around 29% during February-March 2024.

Chart 2: How do current costs per unit compare with this time last year? – % responses

C. Sales Levels

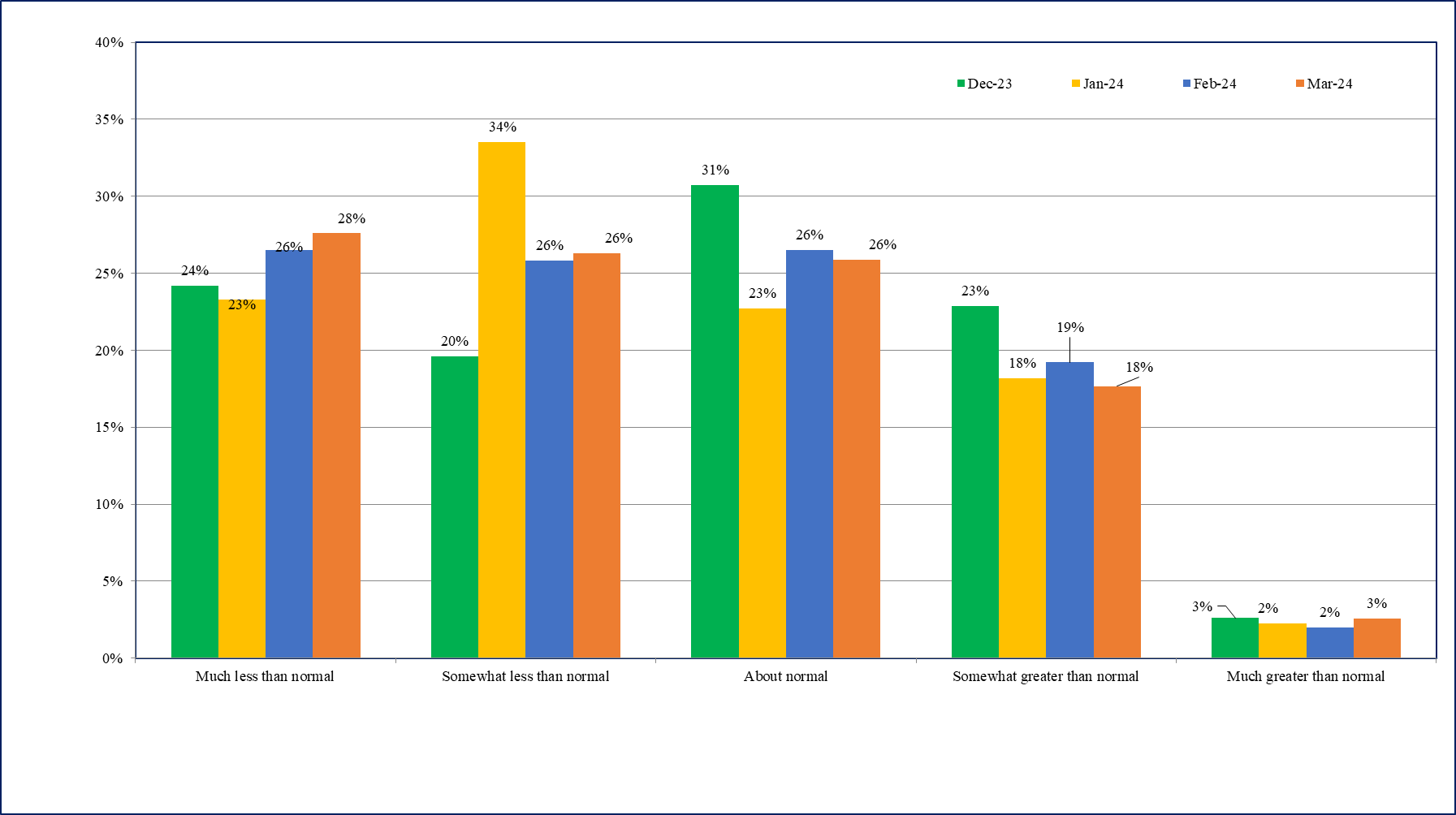

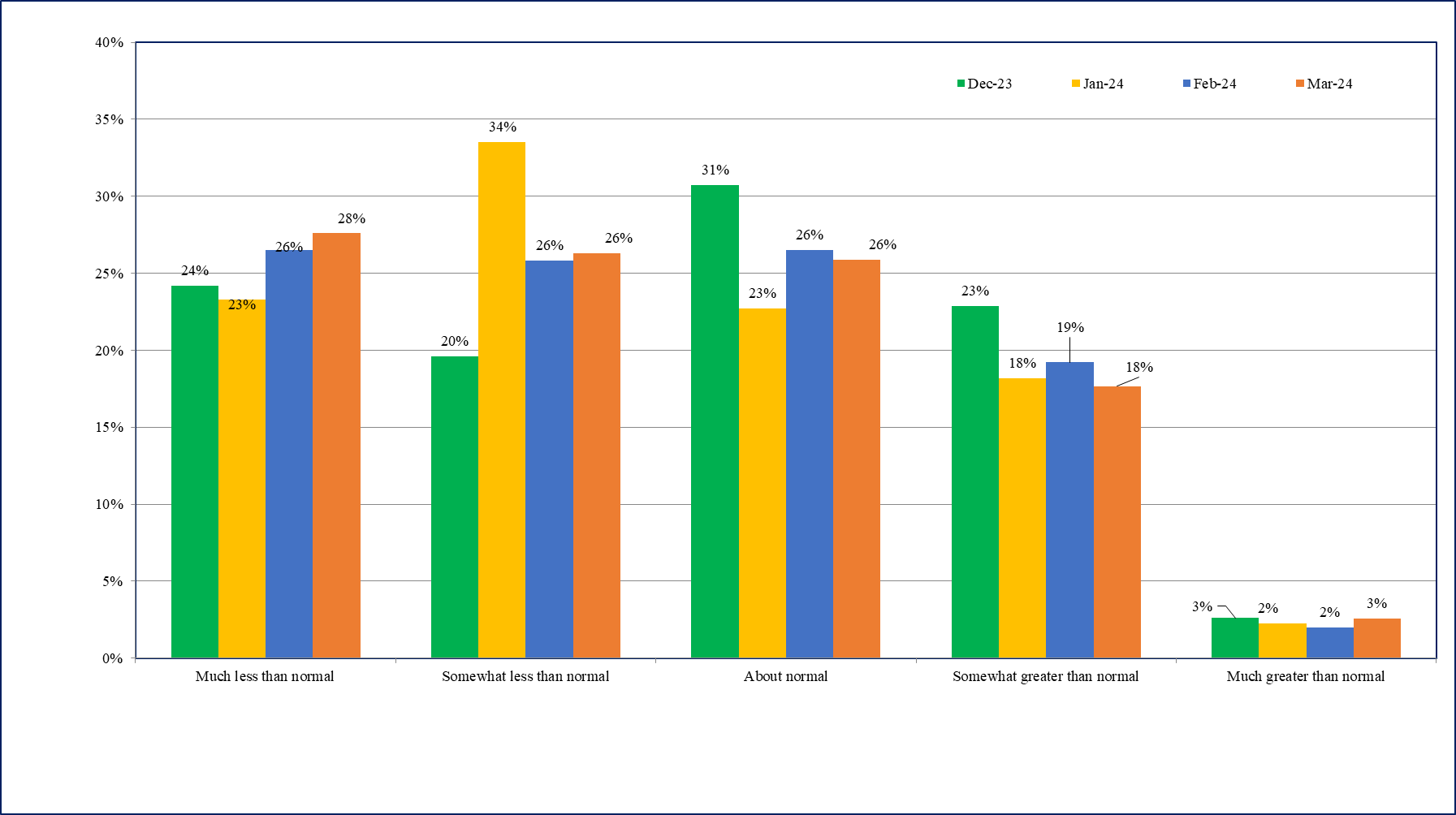

- The sales expectations scenario during February-March 2024 remained similar. Around 18- 19% of the firms are reporting ‘somewhat greater than normal’ (Chart 3).

- About 54% of the firms are still reporting ‘somewhat less than normal’ or lower sales in March 2024 – marginally up from 52% reported in February 2024 2.

2 "Normal" means as compared to the average level obtained in the preceding 3 years, excluding the Covid-19 period.

D. Profit Margins

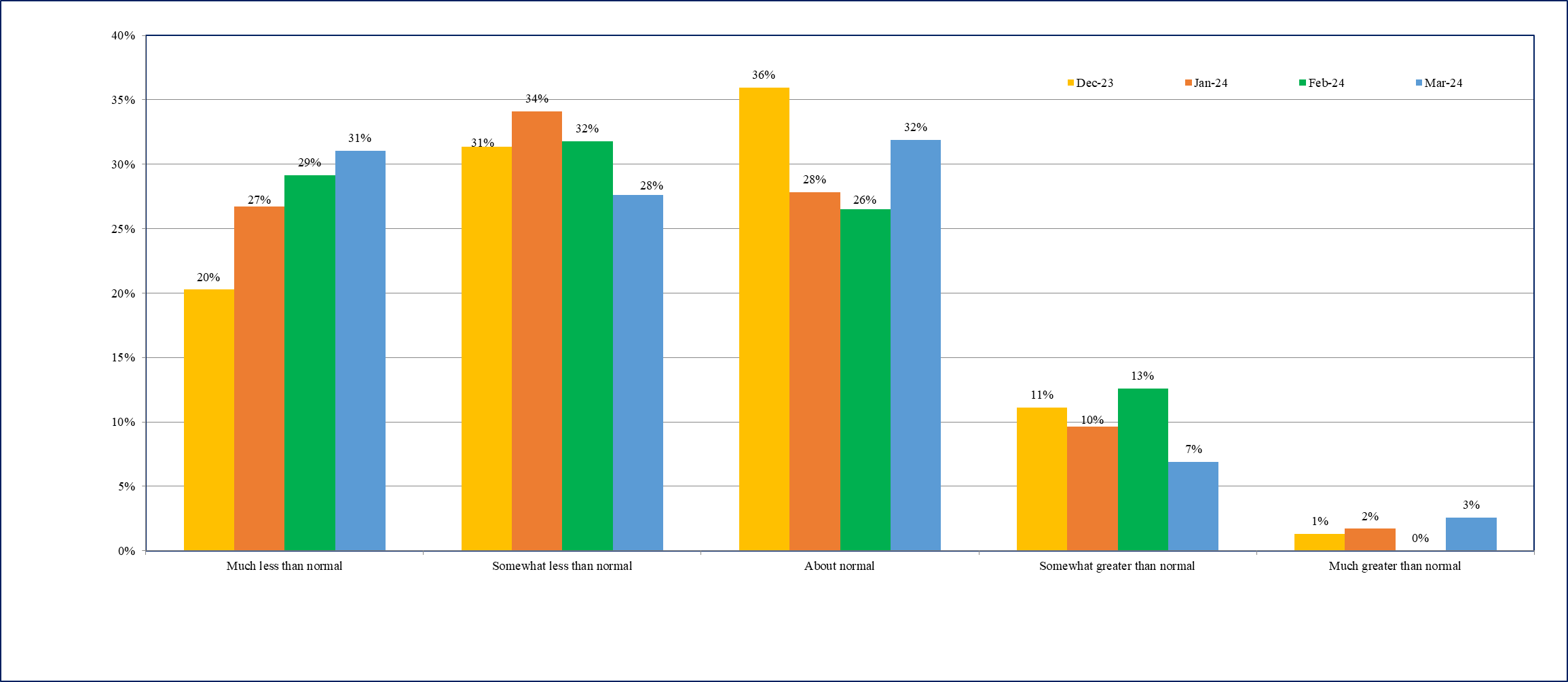

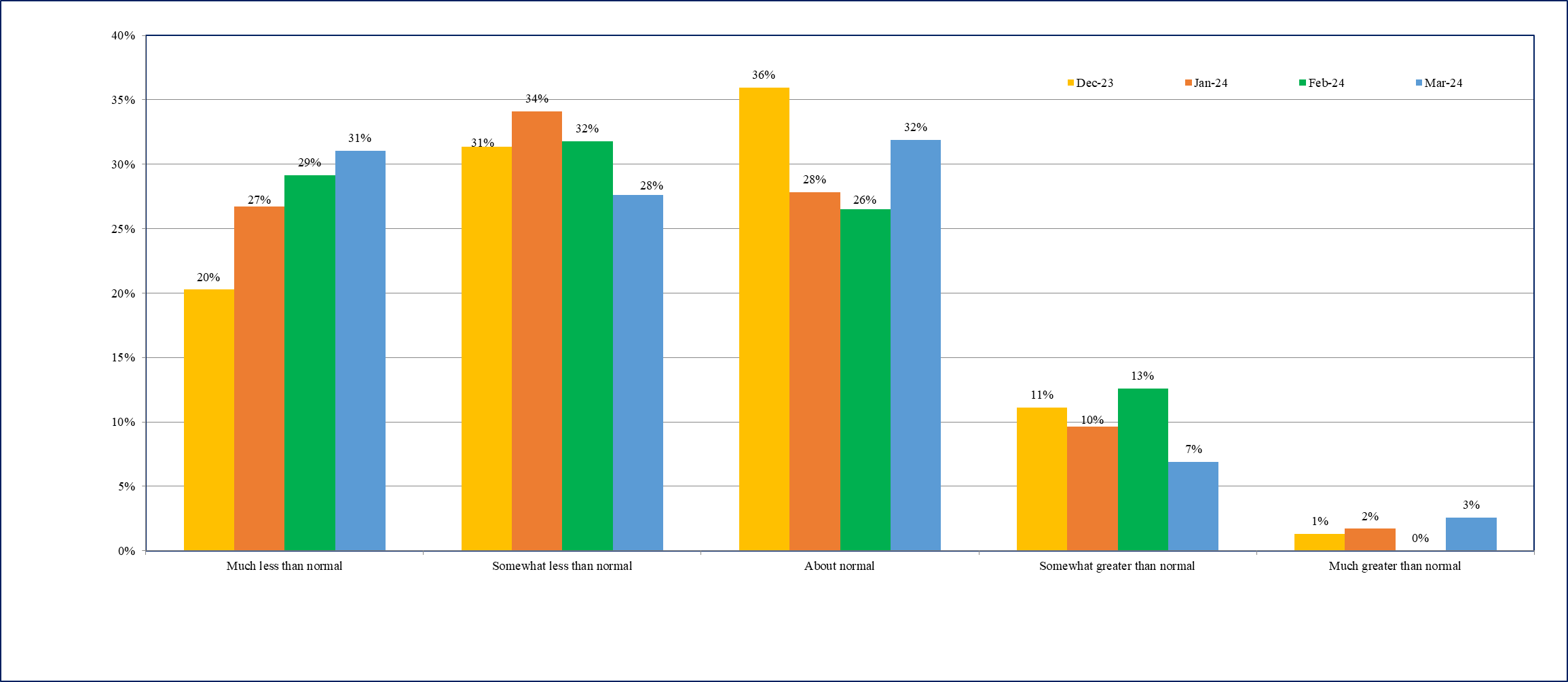

- Around 42% of the firms in March 2024 are reporting profit margins to be ‘about normal’ or greater – marginally up from 40% reported in February 2024 (Chart 4).

- Overall, the profit margins expectations have remained somewhat muted during January- March 2024.

Business Inflation Expectation Survey (BIES) – Questionnaire

|

A. Current Business Conditions

Q1. How do your current PROFIT MARGINS@ compare with "normal"* times?

o Much less than normal

o Somewhat less than normal

o About normal

o Somewhat greater than normal

o Much greater than normal

Q2. How do your current sales levels compare with SALES LEVELS@ during what you consider to be "normal"* times?

o Much less than normal

o Somewhat less than normal

o About normal

o somewhat greater than normal

o Much greater than normal

@ of the main or most important product in terms of sales.

*"normal" means the average level obtained during the corresponding time point of preceding

3 years, excluding the Covid-19 period.

|

B. Current Costs Per Unit^

Q3. Looking back, how do your current COSTS PER UNIT compare with this time last year?

o Down (< -1%)

o About unchanged (-1% to 1%)

o Up somewhat (1.1% to 3%)

o Up moderately (3.1% to 6%)

o Up significantly (6.1% to 10%)

o Up very significantly (> 10%)

' of the main or most important product in terms of sales. |

|

C. Forward Looking Costs Per Unit$

Q4. Projecting ahead, to the best of your ability, please assign a percent likelihood (probability) to

the following changes to costs per unit$ over the next 12 months.

o Unit costs down (less than -1%)

o Unit costs about unchanged (-1% to 1%)

o Unit costs up somewhat (1.1% to 3%)

o Unit costs up moderately (3.1% to 6%)

o Unit costs up significantly (6.1% to 10%)

o Unit costs up very significantly (> 10%)

$ of the main or most important product in terms of sales.

Values should add up to 100%.

|